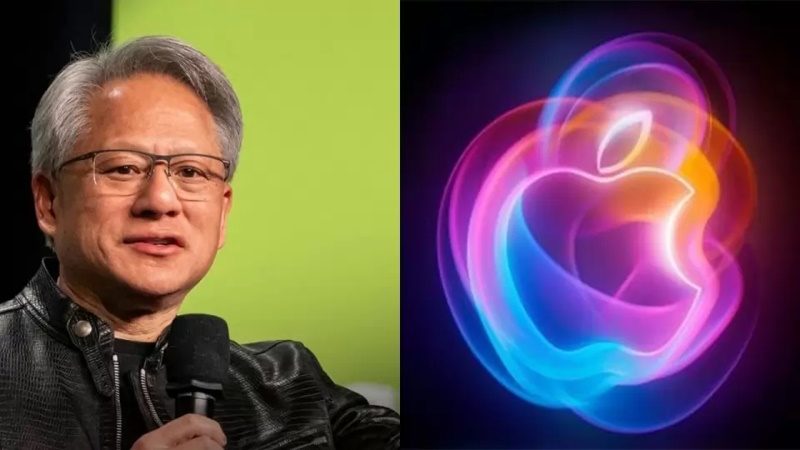

On Friday, Nvidia made headlines by dethroning Apple as the world’s most valuable company, achieving a remarkable stock market value of $3.53 trillion, compared to Apple’s $3.52 trillion, according to data from LSEG. This monumental shift was driven by an insatiable demand for Nvidia’s cutting-edge supercomputing AI chips, reflecting the growing significance of artificial intelligence in today’s economy.

On Friday, Nvidia made headlines by dethroning Apple as the world’s most valuable company, achieving a remarkable stock market value of $3.53 trillion, compared to Apple’s $3.52 trillion, according to data from LSEG. This monumental shift was driven by an insatiable demand for Nvidia’s cutting-edge supercomputing AI chips, reflecting the growing significance of artificial intelligence in today’s economy.

This isn’t the first time Nvidia has occupied the top spot; it briefly claimed this title in June before being surpassed by Microsoft and Apple. Currently, Microsoft holds a market capitalization of $3.20 trillion, indicating a fiercely competitive landscape among these tech giants.

Nvidia’s stock has surged approximately 18% in October alone, fueled by OpenAI’s recent funding announcement of $6.6 billion. As Russ Mould, investment director at AJ Bell, pointed out, “More companies are now embracing artificial intelligence in their everyday tasks and demand remains strong for Nvidia chips.” This robust demand has positioned Nvidia in a favorable market environment, assuming the U.S. economy avoids a significant downturn.

The excitement surrounding Nvidia’s performance is underscored by its upcoming third-quarter earnings report in November. The company has forecasted revenues of $32.5 billion, slightly below the analyst average of $32.90 billion. Morgan Stanley analyst Joseph Moore remains “very bullish” on Nvidia’s long-term outlook, citing strong production ramp-up for its next-generation Blackwell chips, despite earlier production delays.

The collective influence of Nvidia, Apple, and Microsoft is profound, accounting for approximately 20% of the S&P 500 index. The frenzy surrounding AI, expectations of reduced interest rates from the U.S. Federal Reserve, and a positive earnings season have contributed to the S&P 500 reaching an all-time high last week. Nvidia’s impressive growth has also increased its attractiveness among option traders, making its options some of the most actively traded in recent months.